You’ve just walked into your bathroom to find a mini-flood courtesy of your toilet’s enthusiastic overflow. The sound of gushing water is still echoing in your ears as you frantically try to stem the tide (literally). Amidst the chaos, a nagging question pops into your head: will your homeowners insurance cover the ensuing water damage? Well, take a deep breath and step away from the porcelain throne – we’re about to look into the details and give you the lowdown on what’s covered and what’s not.

What Causes Toilet Overflow?

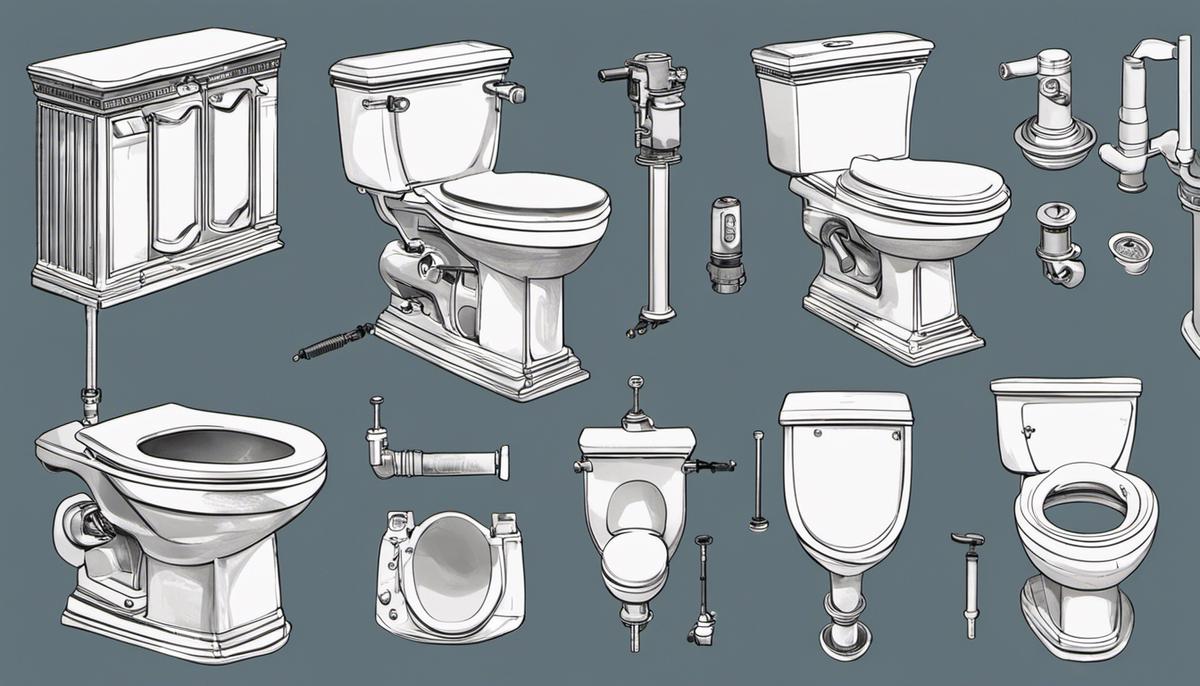

For your toilet to overflow, there needs to be a blockage or malfunction somewhere in the system. It’s not just a matter of flushing one too many wet wipes (although, let’s be real, that doesn’t help). There are a few common culprits behind toilet overflows, and understanding what they are can help you take steps to prevent them.

Clogged Toilets

To start, there’s the issue of clogged toilets. You might think you’re being careful about what you flush, but sometimes those pesky paper products or other debris can get stuck in the pipes, causing a backup.

Faulty Flappers

What about those flappers that cover the hole at the bottom of your toilet tank? If they don’t seal properly, water can continuously flow into the bowl, leading to an overflow.

Consequently, a faulty flapper can waste a lot of water and increase your utility bills. And if you’re not around to notice the problem, you might come home to a flooded bathroom. Not exactly the welcome you were hoping for.

Is Water Damage from Toilet Overflow Covered?

Any homeowner who has experienced a toilet overflow knows the panic that sets in as you watch water spread across your floor. But will your homeowners insurance policy come to the rescue?

Standard Homeowners Insurance Policies

Besides providing coverage for your home’s structure, standard homeowners insurance policies typically include protection against water damage caused by sudden and accidental events, such as a toilet overflow.

Exceptions and Limitations

For instance, if the toilet overflow is caused by your failure to maintain the toilet or plumbing system, your insurance company might not cover the damage.

Indeed, it’s crucial to review your policy’s fine print, as some insurers may exclude coverage for water damage caused by certain circumstances, such as a sewer backup or flooding from an outside source. You’ll want to make sure you understand what’s covered and what’s not, so you’re not left high and dry (or in this case, soggy and stressed) when disaster strikes.

What to Do in Case of a Toilet Overflow

Not every toilet overflow is a catastrophic event, but it’s still a messy and frustrating situation that requires swift action to prevent further damage.

Immediate Action

Between the shock and the panic, take a deep breath and turn off the water supply to the toilet by locating the shut-off valve behind the toilet and giving it a clockwise turn. This will prevent more water from flowing into the toilet bowl and reduce the damage.

Preventing Future Occurrences

Beneath the surface of your toilet’s porcelain throne lies a complex system that can be prone to clogs and malfunctions. Take the time to inspect your toilet’s internal mechanisms and clear any blockages that might be lurking.

Further, consider investing in a toilet overflow prevention device, which can detect excess water levels and shut off the water supply automatically. It’s a small price to pay for the peace of mind that comes with knowing your bathroom floor won’t suddenly turn into a mini-swimming pool.

Filing a Claim for Water Damage

Now that you’ve assessed the situation and taken steps to mitigate further damage, it’s time to file a claim with your insurance company. This can seem like a daunting task, but it’s a necessary step in getting your home back to normal.

Documenting the Damage

After the immediate danger has passed, take photos and videos of the affected area, including any standing water, damaged flooring, and affected walls. Make a list of all damaged items, including their value and age. This documentation will be important in supporting your claim.

Working with Your Insurance Company

Water damage can be a messy and frustrating experience, but your insurance company is there to help. They’ll send an adjuster to assess the damage and guide you through the repair process.

Damage to your home can be stressful, but working with your insurance company doesn’t have to be. Be prepared to provide detailed information about the incident, including when it happened and what you’ve done to mitigate the damage. Stay organized, keep detailed records, and ask questions if you’re unsure about anything. By working together, you can get your home back to its pre-damage state in no time.

Preventing Toilet Overflow in the First Place

Your best defense against toilet overflow-induced water damage is to prevent it from happening in the first place. By taking a few simple steps, you can significantly reduce the risk of a messy and costly disaster.

Regular Maintenance

Preventing clogs is key to avoiding toilet overflows. Make it a habit to regularly inspect and clean your toilet’s drain line, and don’t flush items that can cause blockages, such as sanitary products or wipes.

Upgrades and Repairs

After installing a new toilet or replacing old parts, ensure that everything is properly secured and functioning correctly to minimize the risk of overflow.

Another way to upgrade your toilet’s safety features is to install a toilet overflow prevention device, which can detect excess water levels and shut off the water supply to prevent flooding. By investing in these preventive measures, you’ll not only avoid the hassle of water damage but also save yourself from the financial burden of repairs.

Special Considerations

Many homeowners assume that their insurance policy covers all types of water damage, but that’s not always the case. In the context of toilet overflows, you’ll want to review your policy carefully to ensure you’re protected.

Older Homes

Considerations for older homes are unique, as they often have outdated plumbing systems that can increase the risk of toilet overflows. If you live in an older home, you may need to invest in additional coverage or take extra precautions to prevent water damage.

High-Risk Areas

Above all, if you live in an area prone to flooding or heavy rainfall, you’ll want to pay close attention to your policy’s water damage coverage. You may need to purchase a separate flood insurance policy to ensure you’re fully protected.

Hence, if you live in a high-risk area, it’s crucial to review your policy regularly and consider adding additional coverage. You don’t want to be caught off guard in the event of a toilet overflow or other water-related disaster. By understanding your policy and taking proactive steps, you can rest easy knowing your home is protected.

Conclusion

Taking this into account, you’ve now got a better understanding of what’s covered and what’s not when it comes to water damage from a toilet overflow. Your homeowners insurance will likely have your back, but only if you’ve taken care of regular maintenance and didn’t ignore any warning signs. So, go ahead and breathe a sigh of relief, but don’t get too comfortable – stay on top of those toilet troubles to avoid any nasty surprises down the line.

![How to Remove Crystallized Urine [Explained]](https://homepander.com/wp-content/uploads/2022/02/How-To-Remove-Crystallized-Urine.jpg)

![How To Clean Dark Grout That Has Turned White [5 Easy Ways]](https://homepander.com/wp-content/uploads/2021/12/How-To-Clean-Dark-Grout-That-Has-Turned-White.webp)