So, you’re sitting comfortably in your rented apartment, when suddenly you hear the dreaded sound of gushing water coming from the bathroom.

You rush in to find that your toilet has overflowed, flooding the entire room.

Panic sets in as you wonder how you’ll pay for the damages. But wait, you have renters insurance – will it cover this mess? The answer isn’t a simple yes or no. It depends on the specifics of your policy and the circumstances surrounding the overflow. Let’s dive in to find out what you need to know.

What is Renters Insurance?

While you may think that renters insurance is only for protecting your personal belongings, it’s actually much more comprehensive than that.

In essence, renters insurance provides financial protection for you and your personal property in the event of unexpected events or accidents.

Definition and Purpose

Prioritizing your financial security, renters insurance is designed to safeguard your assets and provide peace of mind in case something goes wrong.

It’s an affordable way to ensure that you’re prepared for the unexpected, giving you the freedom to focus on more important things in life.

Typical Coverage

Covering a range of scenarios, renters insurance typically includes protection for your personal property, liability, and additional living expenses.

This means that if your belongings are damaged or stolen, or if you’re found responsible for damages to someone else’s property, you’ll have the financial support you need to get back on track.

Even more, typical renters insurance policies may also cover temporary housing costs if you’re unable to live in your rental due to damage or repairs.

This can be a huge relief, especially if you’re forced to move out of your home unexpectedly. With renters insurance, you can rest assured that you’ll have a safety net in place to help you navigate life’s unexpected twists and turns.

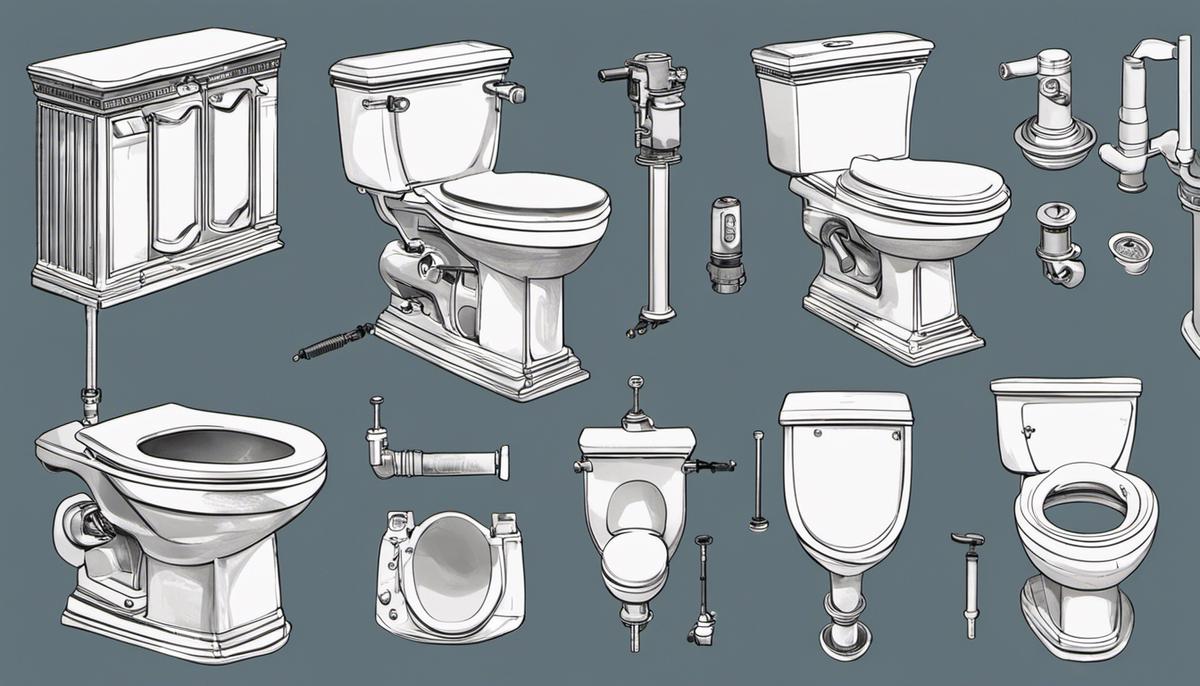

What is Considered a Toilet Overflow?

Even if you’re familiar with toilet overflows, it’s vital to understand what exactly constitutes one. In the context of renters insurance, a toilet overflow refers to an unexpected release of water from your toilet, resulting in damage to your personal property or the rental unit.

Definition and Examples

Around the clock, your toilet is working to dispose of waste and excess water. However, when something goes awry, you may experience an overflow.

This can manifest in various ways, such as water pouring out of the toilet bowl, seeping from the base, or even flooding the surrounding area.

Common Causes

Across the United States, toilet overflows are a common issue, often caused by clogs, faulty flappers, or mineral buildup. These problems can lead to a sudden and unexpected release of water, resulting in costly damage.

Indeed, some common causes of toilet overflows might surprise you. For instance, using too much toilet paper or flushing items that shouldn’t be flushed, like sanitary products or paper towels, can clog your toilet and lead to an overflow. Additionally, if you live in an older building, mineral buildup in the pipes can cause the toilet to malfunction, resulting in an overflow.

Is Toilet Overflow Covered by Renters Insurance?

The answer to this question is not a simple yes or no. It depends on the specifics of your policy and the circumstances surrounding the overflow.

Standard Policy Coverage

The standard renters insurance policy typically covers sudden and accidental damage to your personal property, including water damage caused by a toilet overflow.

Exceptions and Limitations

Exceptions to this coverage may apply if the overflow was caused by your negligence or failure to maintain the toilet properly.

Consequently, if you failed to report a leaky toilet or ignored signs of wear and tear, your insurance company might deny your claim.

Additionally, if the overflow was caused by a gradual issue, such as a slow leak, rather than a sudden event, you might not be covered. It’s imperative to review your policy and understand what is excluded or limited to avoid any surprises.

What to Do in Case of a Toilet Overflow

Many toilet overflows can cause significant damage to your rental property, but acting quickly can minimize the harm. In the event of a toilet overflow, it’s imperative to take immediate action to prevent further damage and ensure you’re prepared to file a claim with your renters insurance provider.

Immediate Steps to Take

For your safety, turn off the water supply to the toilet by locating the shut-off valve behind the toilet and giving it a clockwise turn.

Next, contain the spill by blocking the flow of water with towels or a mop, and then start cleaning up the mess. Be sure to take photos and videos of the damage for evidence.

Filing a Claim

An imperative step in getting compensation for the damage is to notify your renters insurance provider as soon as possible. They’ll guide you through the claims process and provide you with the necessary forms and documentation.

A detailed and accurate account of the incident will help your insurance provider process your claim efficiently.

Be prepared to provide information about the cause of the overflow, the extent of the damage, and any steps you’ve taken to mitigate the damage.

Keep receipts for any temporary repairs or cleaning services you’ve hired, as these may be reimbursable expenses. By following these steps, you’ll be well on your way to getting the compensation you need to restore your rental property to its original state.

Factors Affecting Coverage and Payout

Despite the standard coverage for toilet overflow, there are certain factors that can affect the extent of coverage and payout. These include:

- Policy limits and deductibles

- Preventable damage and negligence

- The cause of the overflow (e.g., sudden and accidental vs. gradual wear and tear)

Any discrepancies in your policy or failure to maintain your rental unit can impact your claim.

Policy Limits and Deductibles

Payout amounts are capped at your policy’s limit, and you’ll need to pay your deductible before receiving reimbursement. Make sure you understand these amounts to avoid surprises.

Preventable Damage and Negligence

Below the surface, your insurer may investigate whether you took reasonable steps to prevent the overflow or if it resulted from your negligence.

A closer look at preventable damage and negligence reveals that your insurer may deny coverage if they find that you failed to maintain your toilet or ignored signs of a potential issue.

For instance, if you knew about a leaky toilet and didn’t fix it, your insurer might not cover the resulting damage. It’s important to stay on top of maintenance and repairs to ensure you’re protected in case of an unexpected overflow.

Additional Tips and Considerations

Not all toilet overflows are created equal, and your renters insurance policy may have specific requirements or exclusions.

For example, if you’re away from home for an extended period, you may need to take extra steps to prevent damage. Be sure to:

- Regularly inspect your toilet for signs of wear or damage

- Keep a record of maintenance and repairs

- Notify your landlord or property manager of any issues

After reviewing your policy, you’ll have a better understanding of what’s covered and what steps you need to take to protect yourself and your belongings.

Preventing Toilet Overflows

Besides having the right insurance coverage, taking proactive steps to prevent toilet overflows can save you time, money, and hassle. Make sure to regularly clean your toilet, check for leaks, and avoid flushing items that can clog your pipes.

Reviewing and Customizing Your Policy

An important part of protecting yourself from toilet overflows is understanding your renters insurance policy. Take the time to review your policy and customize it to fit your specific needs.

In addition, consider adding additional coverage for high-value items, such as electronics or jewelry, that may be damaged in a toilet overflow.

You may also want to look into optional endorsements, such as sewer backup coverage, to give you extra protection. By taking these steps, you can rest easy knowing you’re prepared for any unexpected events.

Conclusion

Hence, you now know that renters insurance can indeed cover toilet overflow damages, but it depends on the circumstances. If the overflow was sudden and accidental, your policy will likely kick in to help with repairs and replacement costs.

However, if the damage was caused by your negligence or lack of maintenance, you might be on the hook for the expenses. So, take the time to review your policy and make sure you understand what’s covered, and what’s not, to avoid any surprises down the line.

![How to Remove Crystallized Urine [Explained]](https://homepander.com/wp-content/uploads/2022/02/How-To-Remove-Crystallized-Urine.jpg)

![How To Clean Dark Grout That Has Turned White [5 Easy Ways]](https://homepander.com/wp-content/uploads/2021/12/How-To-Clean-Dark-Grout-That-Has-Turned-White.webp)